Renovating a Rental Property: Practical Aspects

By Editorial Team

Updated on November 8, 2023

Owning a rental apartment is not without challenges to overcome, as it comes with a number of obligations and responsibilities, which aren’t easy to maintain.

In addition, there is various maintenance, renovation, and repair work which requires time and a lot of money, but which is nevertheless essential for the smooth running of a rental property.

In Quebec, all work related to the construction industry is regulated by law, and rental properties are no exception. Thus, it's important to understand all the specifics as they relate to the execution of work in a rental property.

What is the legal framework for renovating a rental property? What modifications is the tenant authorized to make? And what are the tax advantages that you could benefit from by renovating your rental property? In this article, we’ll lay it out for you!

Renovating in a rental property

Photo: Deposit Photo

The renovation of a rental property and its legal framework

First, it should be specified that construction work is governed by Act R-20, i.e the Act respecting labour relations, vocational training and workforce management in the construction industry. Within the confines of this law, construction work includes foundation work, erection, maintenance, renovation, repair, modification and demolition of buildings and civil engineering works, including construction work and floor planning.

However, this law excludes minor work from its scope such as repainting walls, waxing floors or making repairs with plaster. If you’re the property owner, you’ll be able to call on an individual who doesn’t have their licence from the Commission de la construction du Québec to carry out this work.

Photo: Deposit Photo

Indeed, the law suggests that if the work is carried out by those without a professional employer (most of whose activities are related to construction), then the application of Act R-20 is not a concern. Thus, repair or maintenance work for which you’ve hired an individual who doesn’t hold a licence doesn’t represent a legally problematic situation.

However, there are some very important nuances about where the work is done. To this point, a property owner who lives in one of their own dwellings can carry out maintenance, repair, modification or renovation work there, just as the owner of a single-family house could do.

However, for additional modifications or renovation work as understood within this law and carried out to accommodate one of your tenants, it’s imperative to call on a construction contractor holding a valid licence from Régie du bâtiment du Québec. The same restriction applies to renovations made to common areas of any rental property.

Photo: Deposit Photo

For tenants who wish to make changes to their home

Regarding changes that tenants would like to make to their accommodation, it’s always recommended to seek prior permission from the landlord. A point of contention over any modifications made without the landlord’s agreement may result in proceedings before the Régie du logement du Québec as well as damage payments.

Does your tenant want to repaint the walls to hide the current colour? They can do this without a problem. However, as the property owner, you can ask the tenant to repaint everything to the original colour before leaving the premises following the lease end.

Regarding renovations that need to be done promptly, it’s important to be aware that your tenant could proceed without your authorization. Éducaloi specifies three conditions that must be met:

they informed you of the problem or attempted to inform you of it;

you have not taken any action to resolve the problem;

repair is urgent and must therefore be done quickly.

In such situations, your tenant will be entitled to obtain compensatory costs for the materials used during the repair, provided they’ve kept proof of their purchase.

Photo: Deposit Photo

An attractive tax advantage for rental property renovation

First, it’s important to know that as a landlord, you must declare your yearly rental income. In the same way, you’ll have to declare the expenses paid or incurred for your building. In addition to the rental income, you must declare all ancillary income like the income from a laundry room as well as any maintenance-related costs.

As a landlord, you’ll be able to take advantage of a tax deduction for the costs associated with labour and materials used in the maintenance and repair of your rental property. However, this benefit doesn’t apply to the cost of labour if you do the work yourself.

Other expenses can be deducted from your income, reducing the amount of payable tax. Deductible expenses include insurance, maintenance, mortgage interest, municipal and school taxes, property management and utility bills.

A partial refund of GST and QST

If you’re the owner of a new rental property or one that’s undergone major renovations, then you may be entitled to a partial rebate of the GST and QST (certain conditions apply). You may be entitled to this benefit if:

You’re not entitled to an input tax credit;

You’re not entitled to an input tax refund for the GST and QST you paid when you bought the building.

The maximum authorized reimbursement corresponds to approximately 36% of the taxes paid (GST and QST) relating to each of the eligible dwellings in the residential complex. However, the GST cannot exceed $6300 and the GST cannot exceed $7182. Source: Revenu Québec

Get 3 renovation quotes for your rental property project

RenoQuotes.com can help you get quotes for your home renovation project. If you submit your project to us, we’ll put you in contact with top-rated contractors. Fill in the form on the homepage (it only takes a few minutes), and you will get estimates from trusted professionals.

Dial 1-844 828-1588 to speak with one of our customer service representatives

Looking for something else?

Related articles

The latest industry news, interviews, technologies, and resources.

Editorial Team

•08 Nov 2023

While a laundry room is, first and foremost, a space designed for practical use, and its aesthetic aspect is often neglected, one shouldn’t overlook the overall appearance of the often-forgotten space to fine-tune it to the rest of the house. With this in mind, here are décor suggestions for your new laundry room.

Editorial Team

•04 Oct 2024

Natural light is something that every human being requires. It keeps us healthy, happy and productive. Homeowners who are lucky to live in spaces with lots of natural light can likely attest to this.

Amanda Harvey

•31 Mar 2025

Unanticipated noises in the wrong place at the wrong time can be jarring, stressful, and annoying. The best way to deal with it is soundproofing at the source.

Editorial Team

•04 Jun 2025

Waterproofing your foundation is paramount to preserve the integrity of the concrete, prevent basement water leaks, and reduce humidity levels. Doing so is deemed essential to prevent water and moisture found in the soil from seeping into the basement of your home, thus preventing material deterioration and health-hazardous mould growth. Also, foundation waterproofing is a way of controlling the moisture level in your basement and home as a whole, which will in turn reduce your heating and air conditioning bills.

Editorial Team

•05 Mar 2024

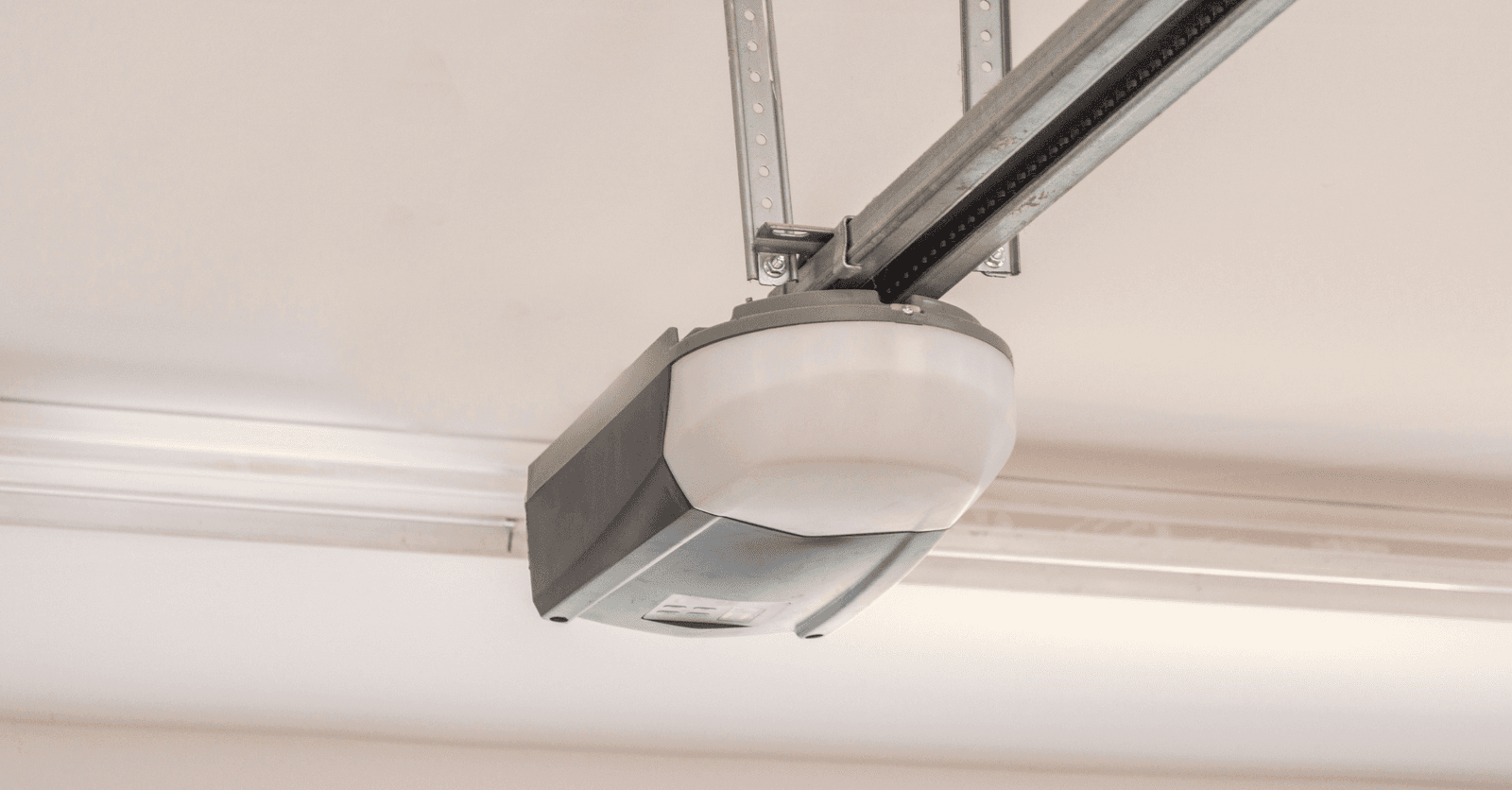

Installing a garage door opener can be a rather technical endeavour, but investing in one is more than worth it. Especially so when you know exactly what type of opener to choose.